End-to -End Budget Planning with Dynamics 365 Finance

Budget Planning with Microsoft Dynamics 365 Finance

What is Budget Planning?

Budget planning is the process of developing a comprehensive financial plan for a specific period, usually a fiscal year. This plan helps estimate revenue, allocate expenses, and monitor performance against goals. By setting financial objectives, projecting income and expenses, allocating resources, and regularly reviewing actual performance against the plan, budget planning supports an organization’s financial stability and helps achieve strategic goals.

Types of Budget planning

Below are the most used types of budget plans by any organization:

- Imposed Budgeting

In this top-down approach, executives set financial goals for the company. Managers implement these goals by establishing budget targets for various departments and cost centers. This type can be beneficial in turnaround scenarios, though it may limit goal alignment across departments.

- Negotiated Budgeting

Combining top-down and bottom-up approaches, negotiated budgeting allows executives to outline specific targets while giving managers and employees shared responsibility in preparing the budget. By involving team members, this approach can increase commitment to achieving budget goals.

- Participative Budgeting

Participative budgeting takes a bottom-up approach, with employees recommending financial targets. While executives offer guidance, they generally adopt the suggestions from managers. This approach grants operational units significant autonomy to set budgets that align closely with their objectives.

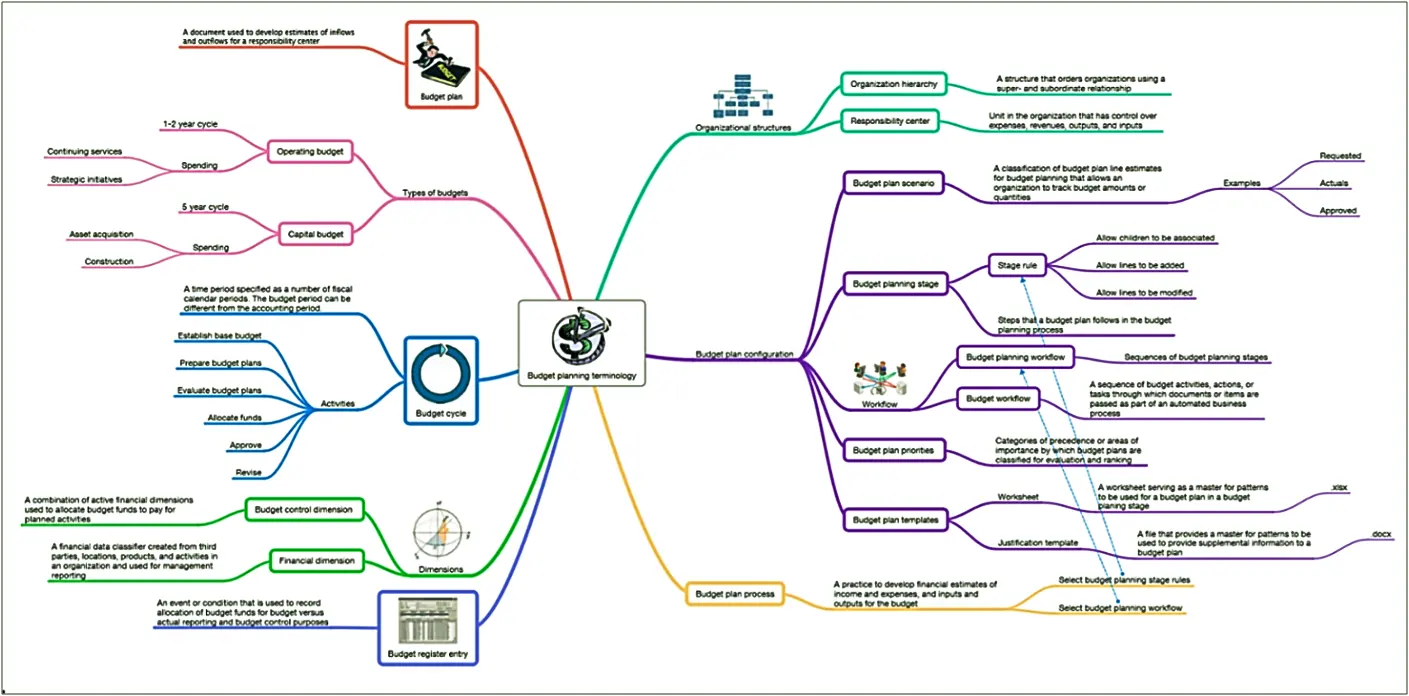

Budget Planning in D365

With Dynamics 365 Finance, organizations can create, analyze, update, and consolidate budget plans across different units and scenarios. The platform automates workflows for review, routing, and approvals and integrates seamlessly with other modules like Financials, Fixed Assets, and HR. This integration enables the inclusion of historical budgets, actual spending, assets, and workforce data into budget plans.

Finalized budget plans can be transferred to budget register entries and used for budget control.

Budget planning in Microsoft Dynamics 365 Finance offers several benefits that can enhance financial management and decision-making within an organization. Here are some key advantages:

- Enhanced Accuracy: Automated processes reduce manual errors, leading to more precise budget forecasts and reports.

- Collaborative Environment: Departments can collaborate within the platform, improving communication and coordination.

- Scenario Analysis: Users can create alternative scenarios to assess the impact of various strategies.

- Integration with Business Operations: Aligns budgeting with other functions like accounting and project management.

- Compliance and Controls: Advanced tracking ensures adherence to financial regulations.

- Time Savings: Streamlined processes free finance teams for more strategic work.

- Flexible Adjustments: Organizations can easily modify budgets based on evolving needs.

- Forecasting Tools: Analytics and machine learning enhance forecasting, supporting better financial predictions.

Budget Planning in D365

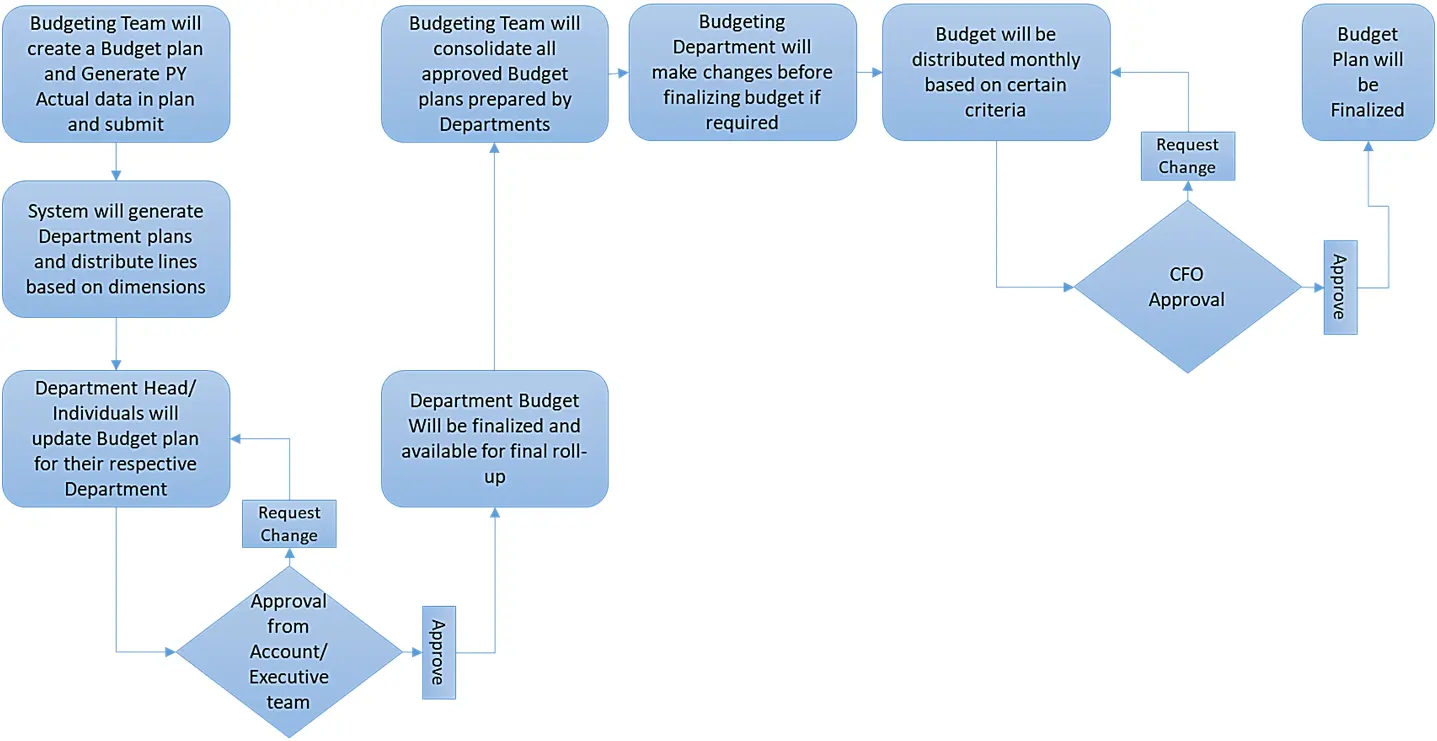

- Create a Process Flow followed by your company for Budget Planning.

First step is to create a process flow that shows your organization’s procedure for formulating a budget. You can use any method that you want to create this flow.

The following example illustrates a process in which the budgeting team calculates baseline amounts for the initial budget and allocates these to various departments. Each department then projects and submits its forecast to the budgeting team, where the budget manager consolidates and refines the estimates. Lastly, the budget manager forwards the adjusted budget figures to the CFO for review, final modifications, and approval.

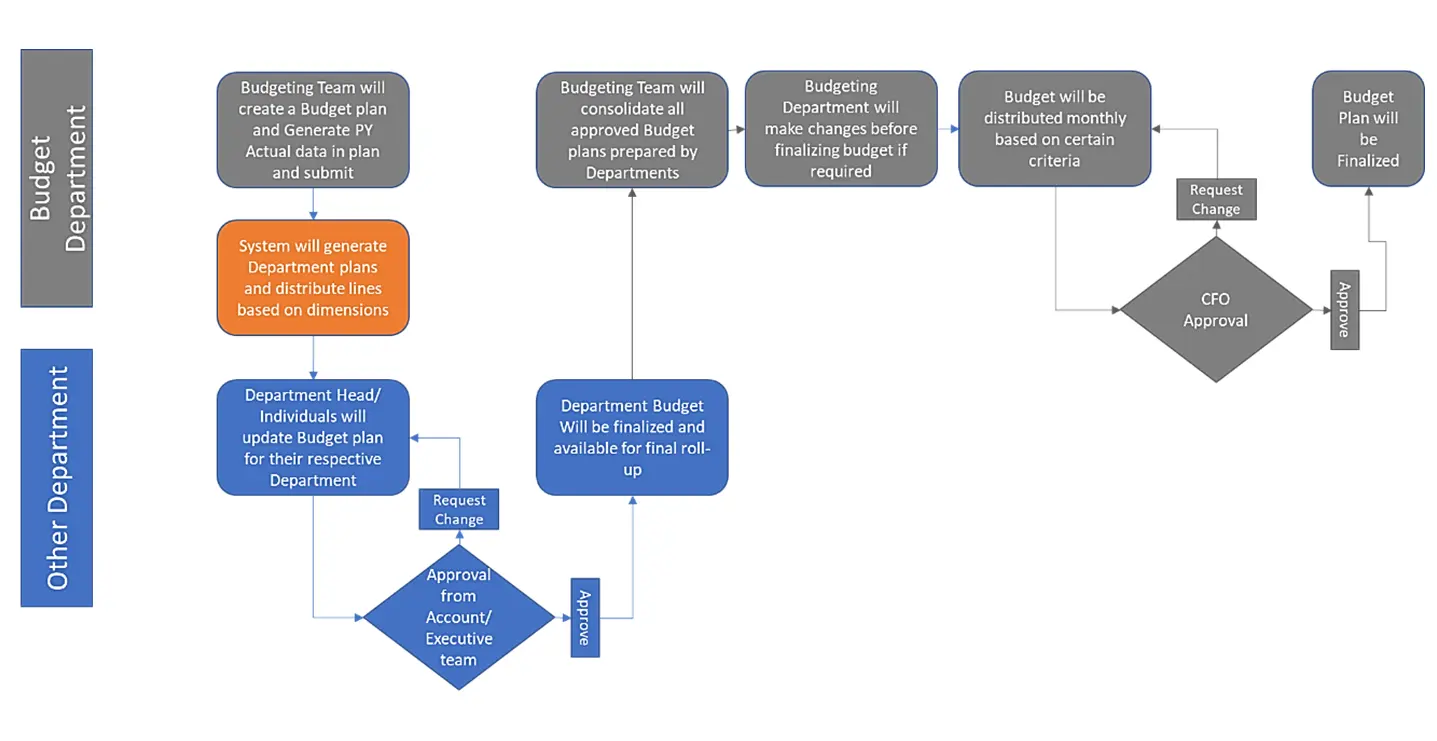

- Categorize the Departments and Management Steps

Next step is to segregate separate flows within departments, in below example, flow is separated between Budgeting and other departments.

- Following the outlined process, configure the following settings in D365:

- Organization hierarchy for Budget Planning

- Budget planning stages

- Budget Planning Scenarios

- Define the workflow for each process

- Create allocation schedule and stage allocation

- Create columns and layouts

- User security

- Budget planning process

Executing Budget Planning in Dynamics 365

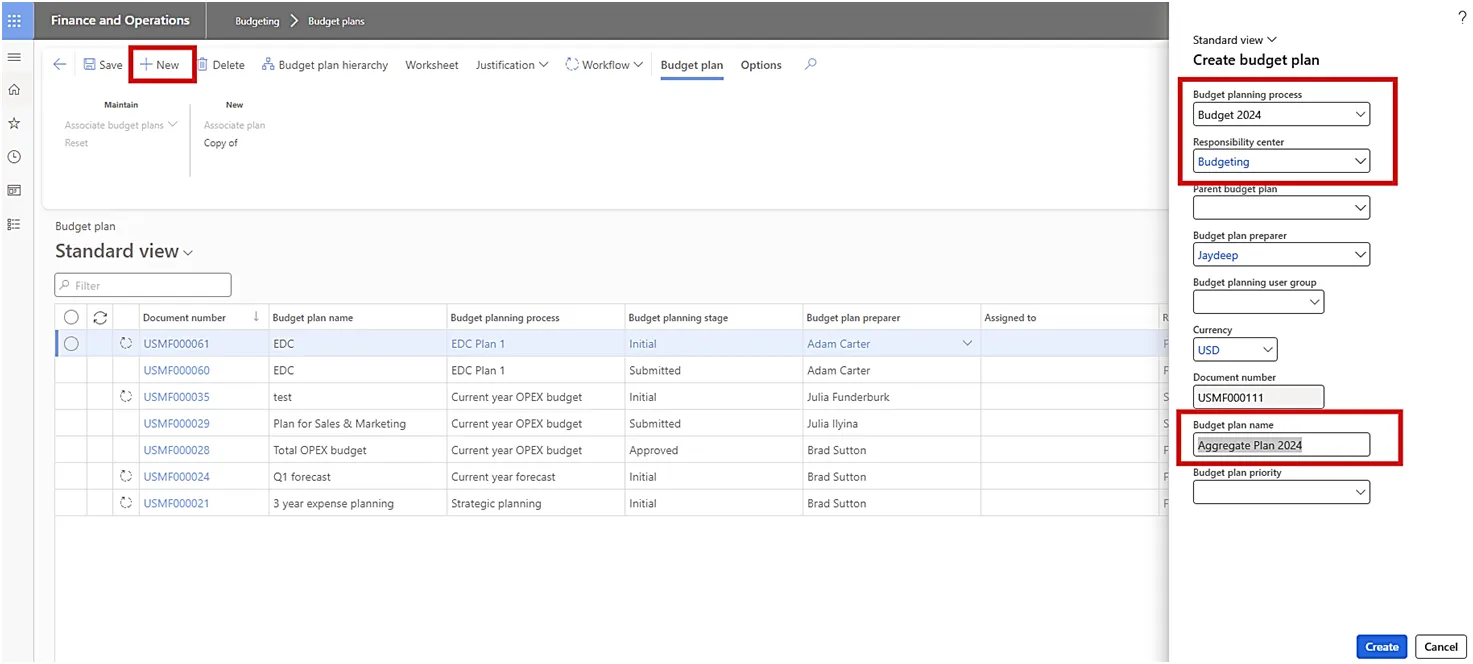

- Budget Plan Creation by Budgeting Team

The budgeting team will start the budget planning process by setting up a structured plan specifically for the budgeting department.

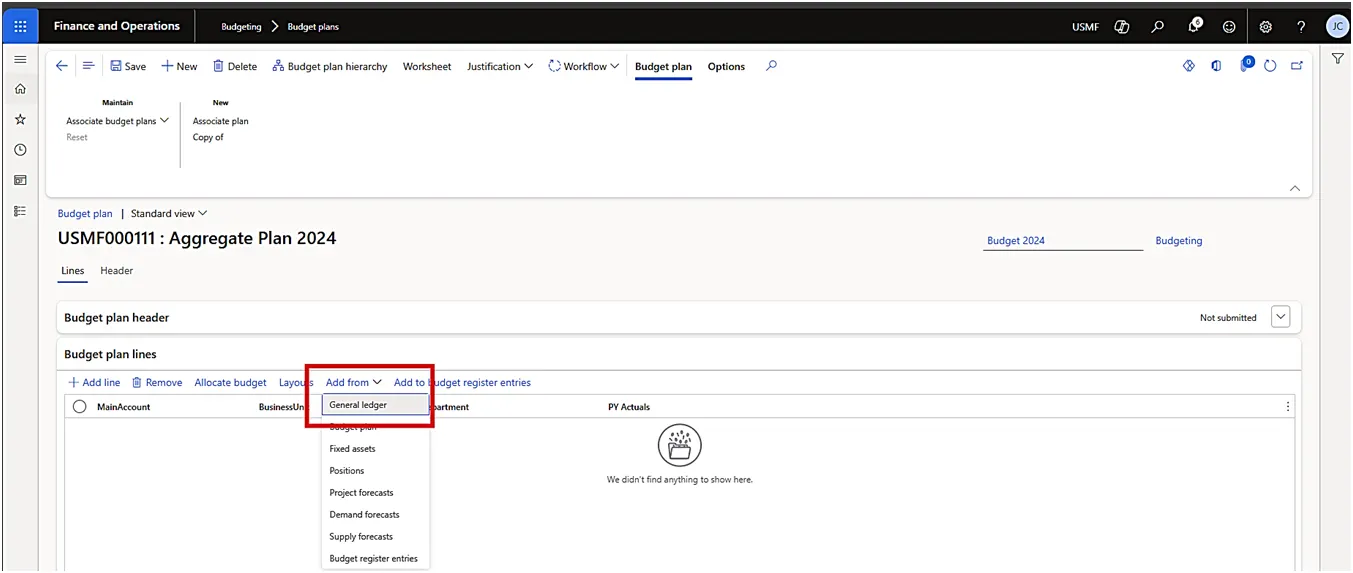

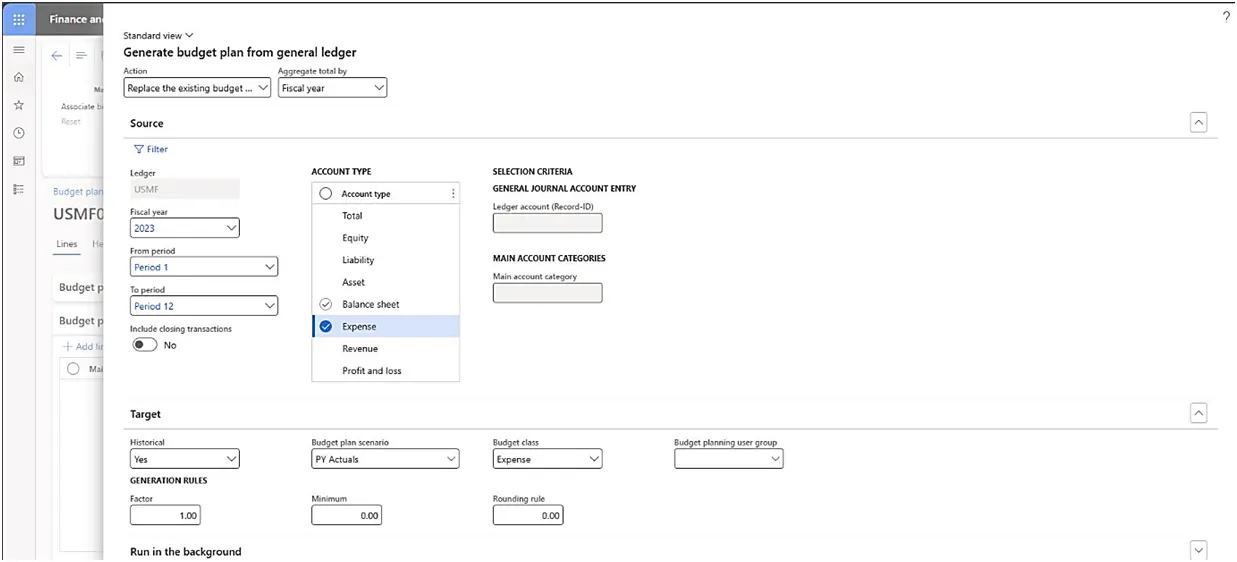

After creating the plan, Budget clerk will add PY actuals to the budget plan:

Data will be added from General ledger, for FY 2023 and Account type will be expense. Target scenario will be PY Actuals.

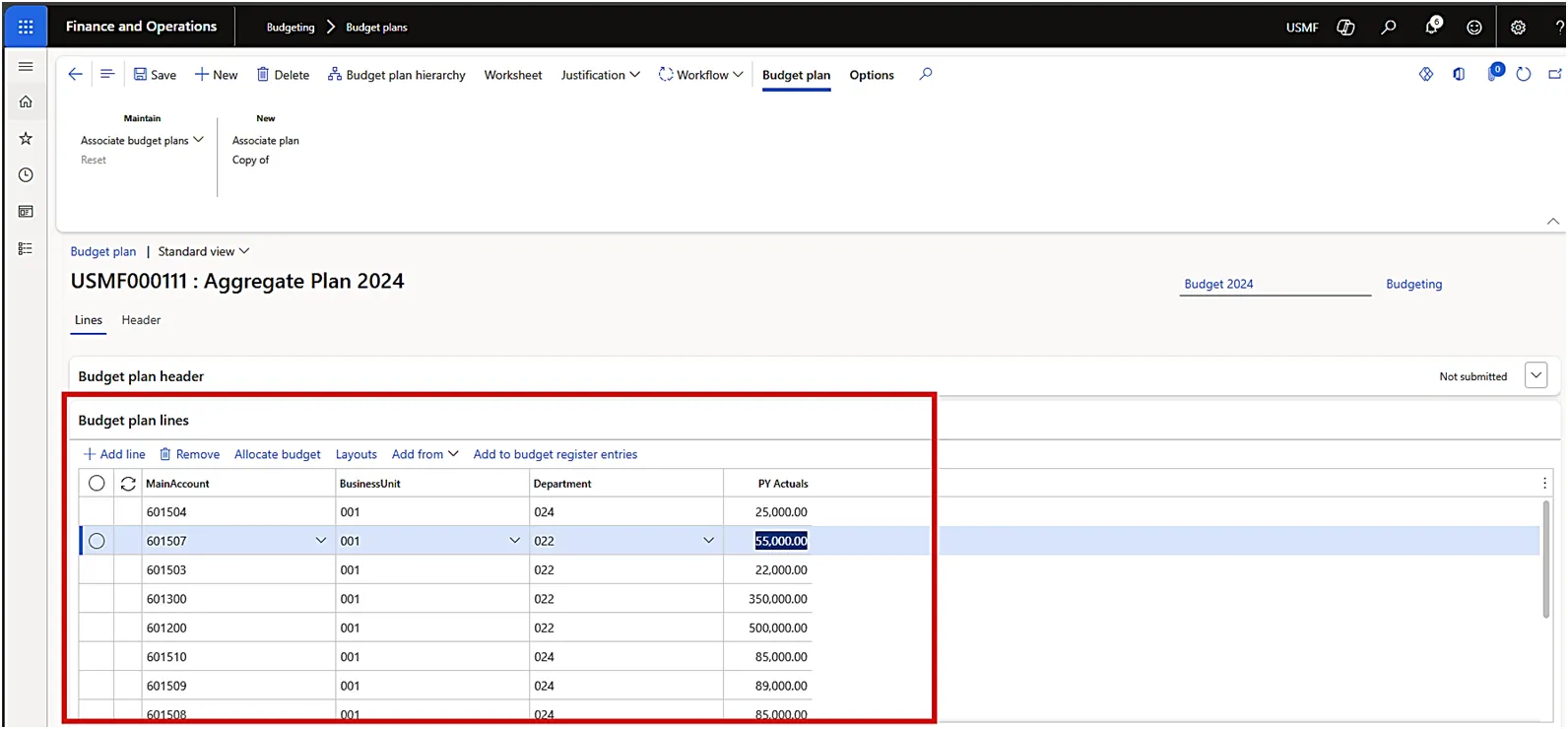

All the previous year balances will be added to the budget plan.

Budget clerk will submit the workflow, and system will activate budget for associated departments in organization hierarchy, assigned to respective department managers:

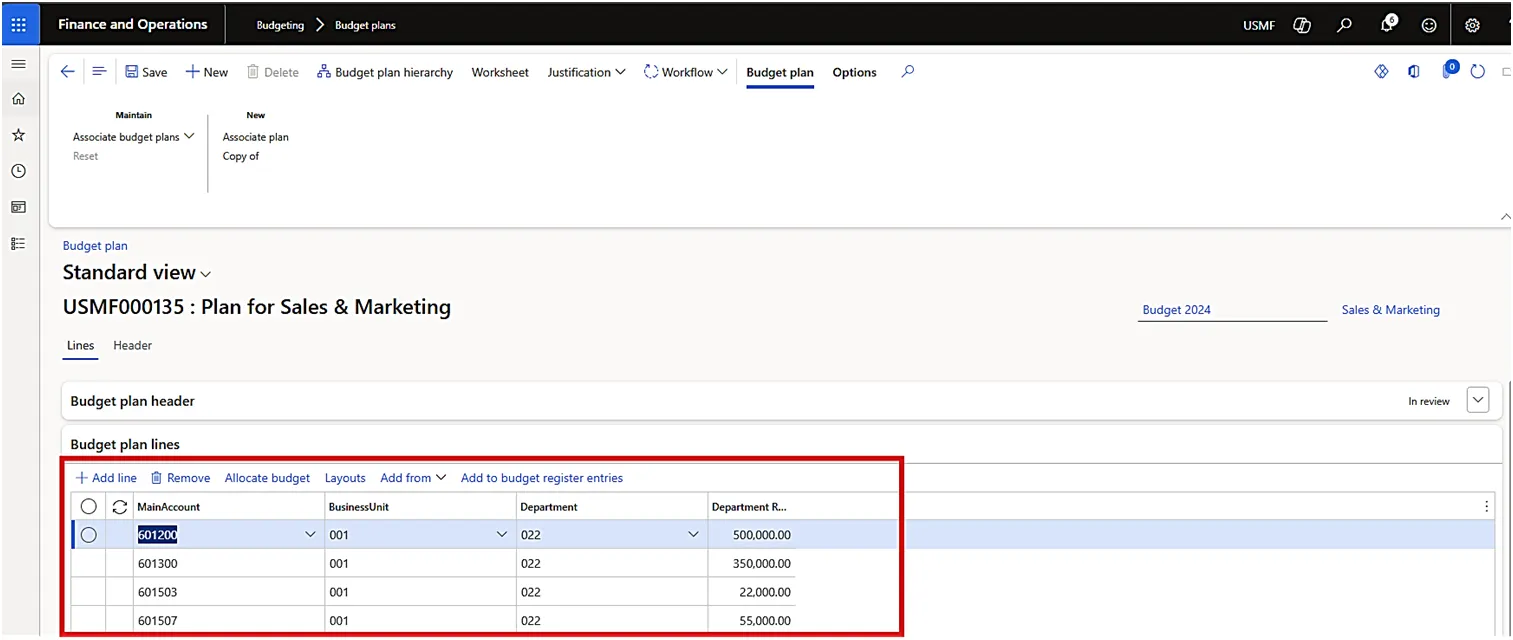

- Budget Plan Update by Departments.

Each department supervisor will receive the budget plan for their respective department in the Estimate stage, prefilled with data from the previous year’s actuals. They are expected to adjust these amounts based on their budget requests for the upcoming year.

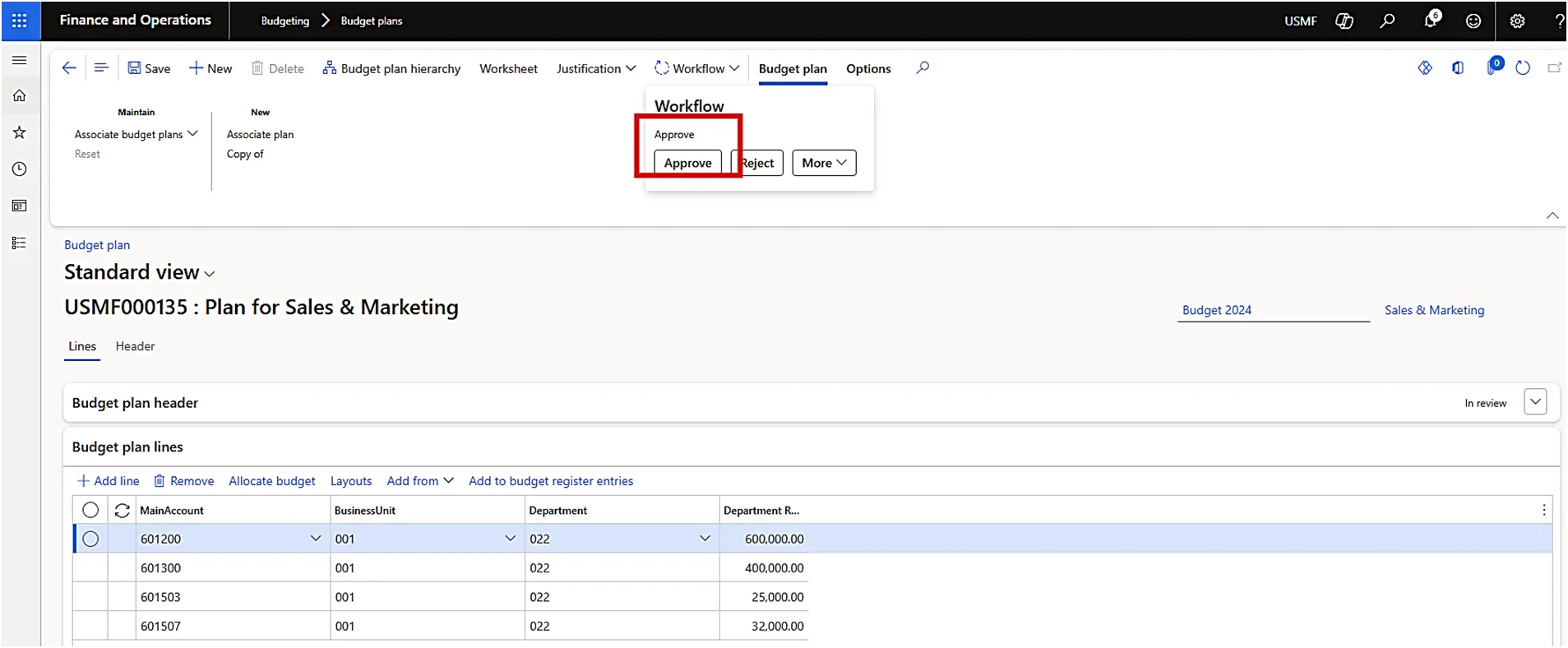

After updating the budget, they will approve the budget, after which it will move to next stage.

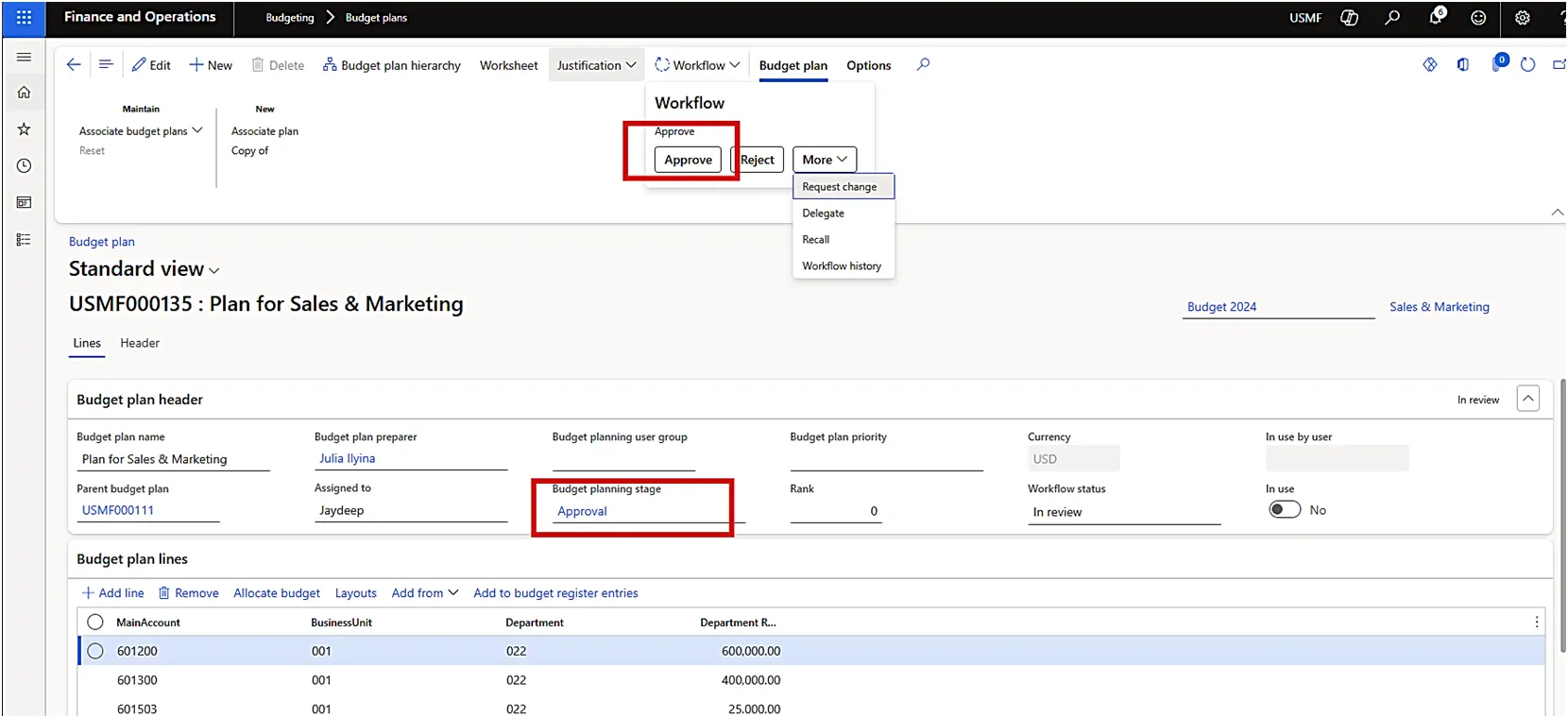

In the Approval stage, the budget will be assigned to the department manager for approval and the manager can also send the budget back to the supervisor for changes if required.

After the approval from the department manager, the plan will move to the Submitted stage and no changes can be made to the budget. Further, it will be available for aggregation.

- Consolidation of Budget by Budgeting Team.

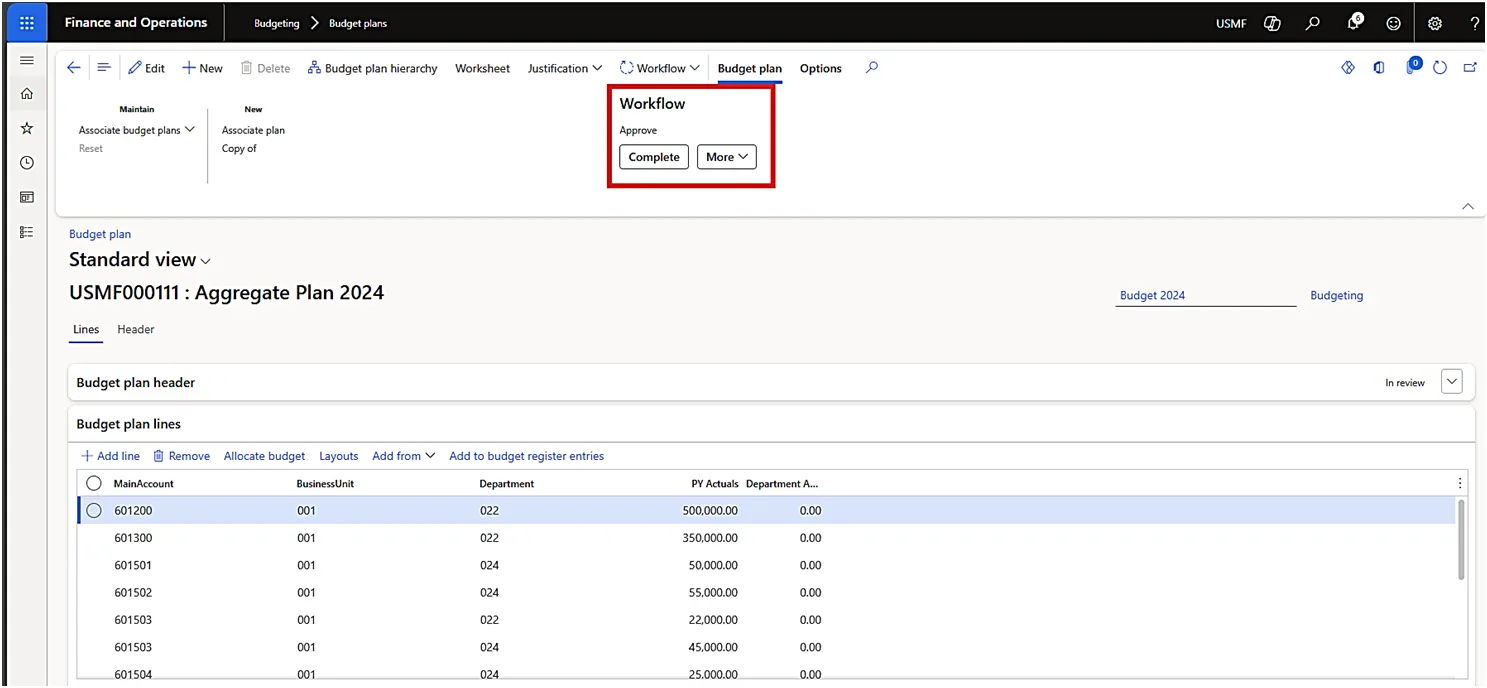

Once the budget plan reaches the Rollup stage and all department managers have approved their respective budgets, the budget clerk will finalize and consolidate the plans.

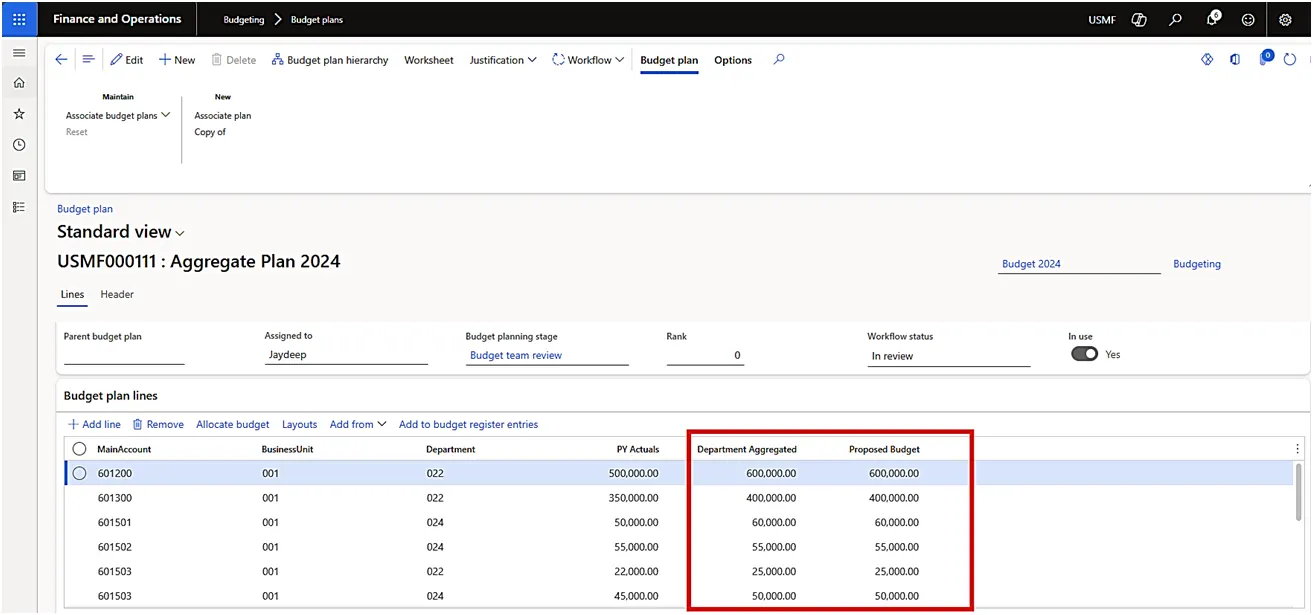

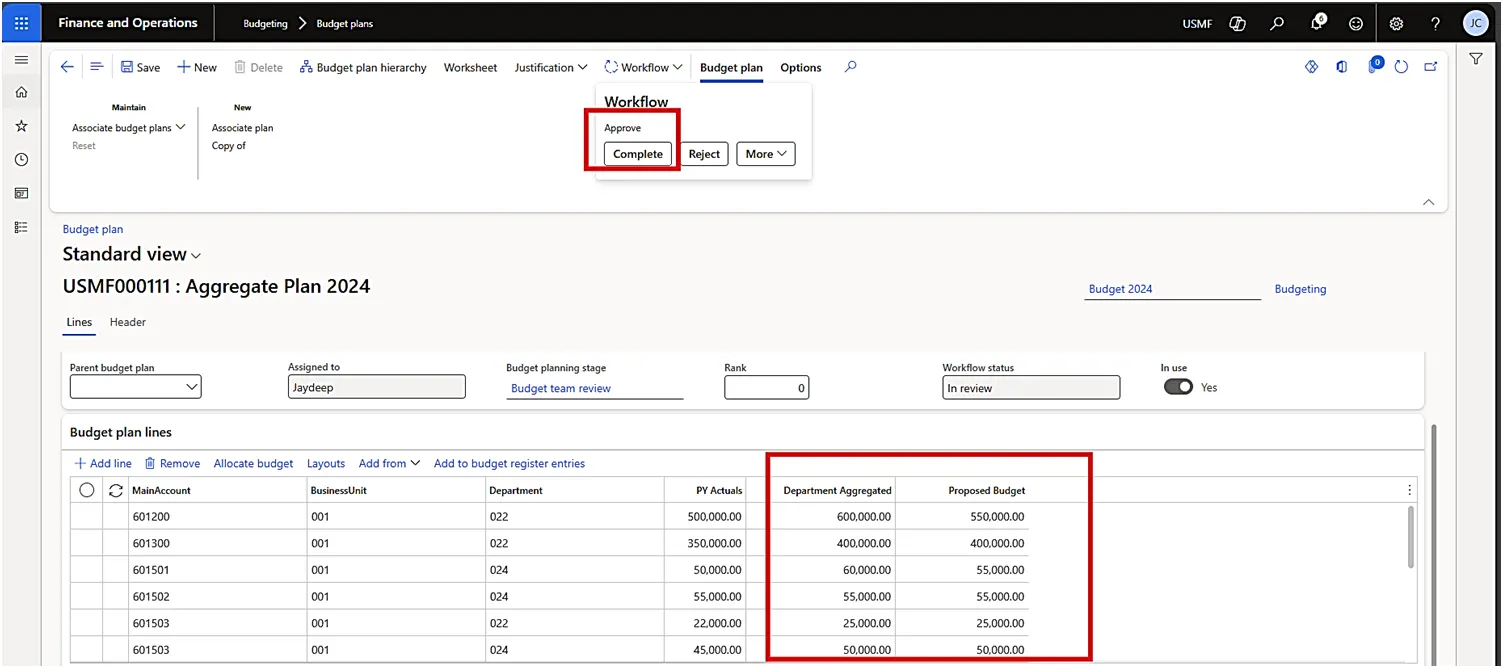

The budget plan will then progress from the Rollup stage to the Budget Team Review stage. At this point, data from all department plans will be combined and displayed under the Department Aggregated column, with a copy also saved in the Proposed Budget section.

Budget plan will be assigned to Budget manager for review and Budget manager can update the amount in Proposed budget and submit for approval to CFO.

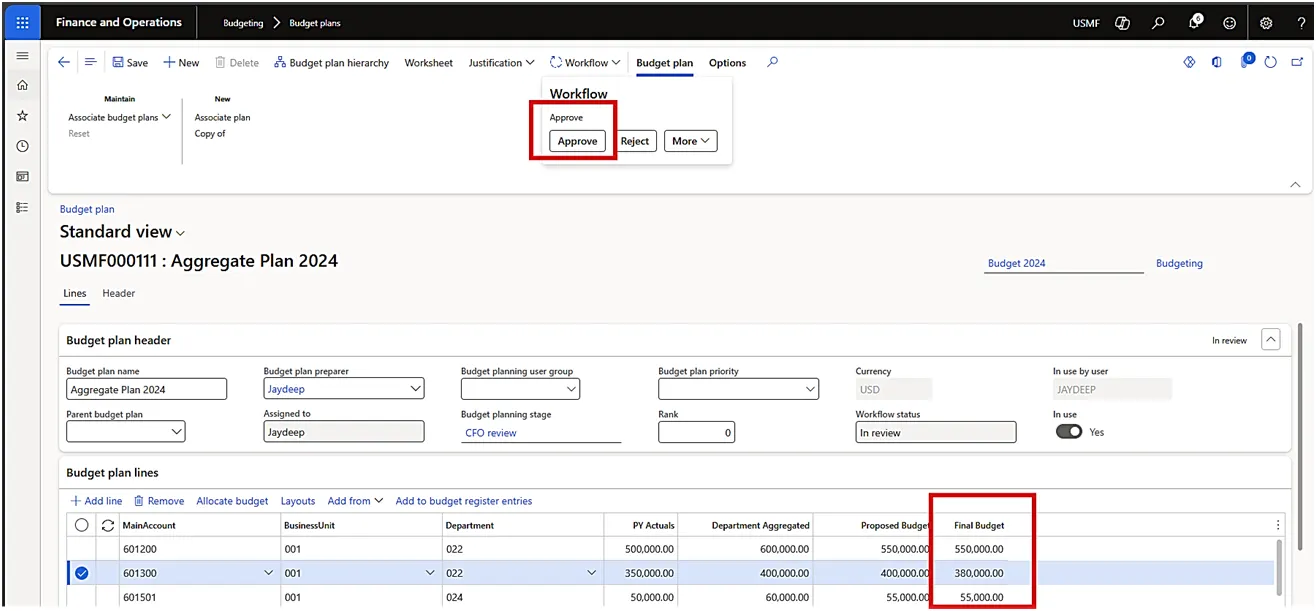

- Approval of Final Budget by the Management.

The budget plan will advance from the Budget Team Review stage to the CFO Review stage, where it will be assigned to the CFO for approval. The proposed budget, as updated by the Budget Manager, will be copied to the “Final Budget” column, allowing the CFO to make any necessary adjustments before finalization.

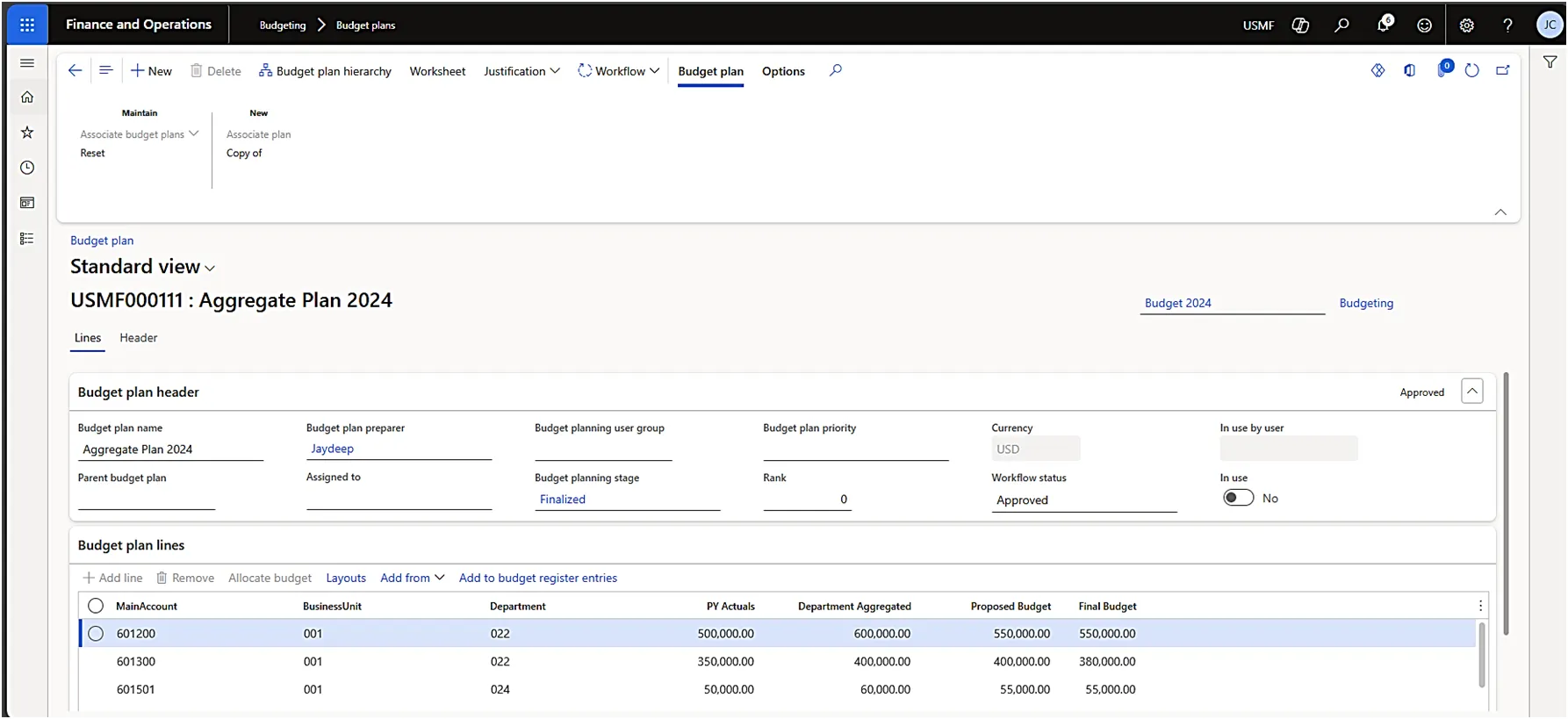

After CFO approval, Budget plan will be moved to Finalized stage and no changes can be made to the budget.

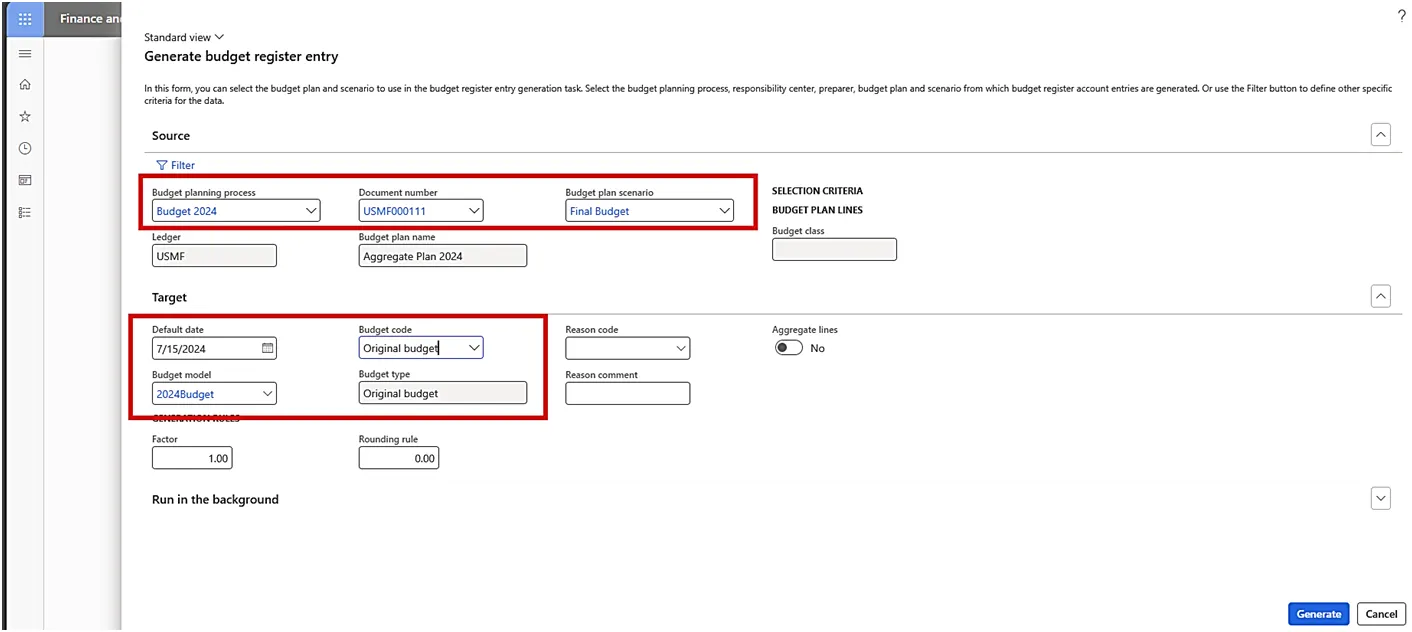

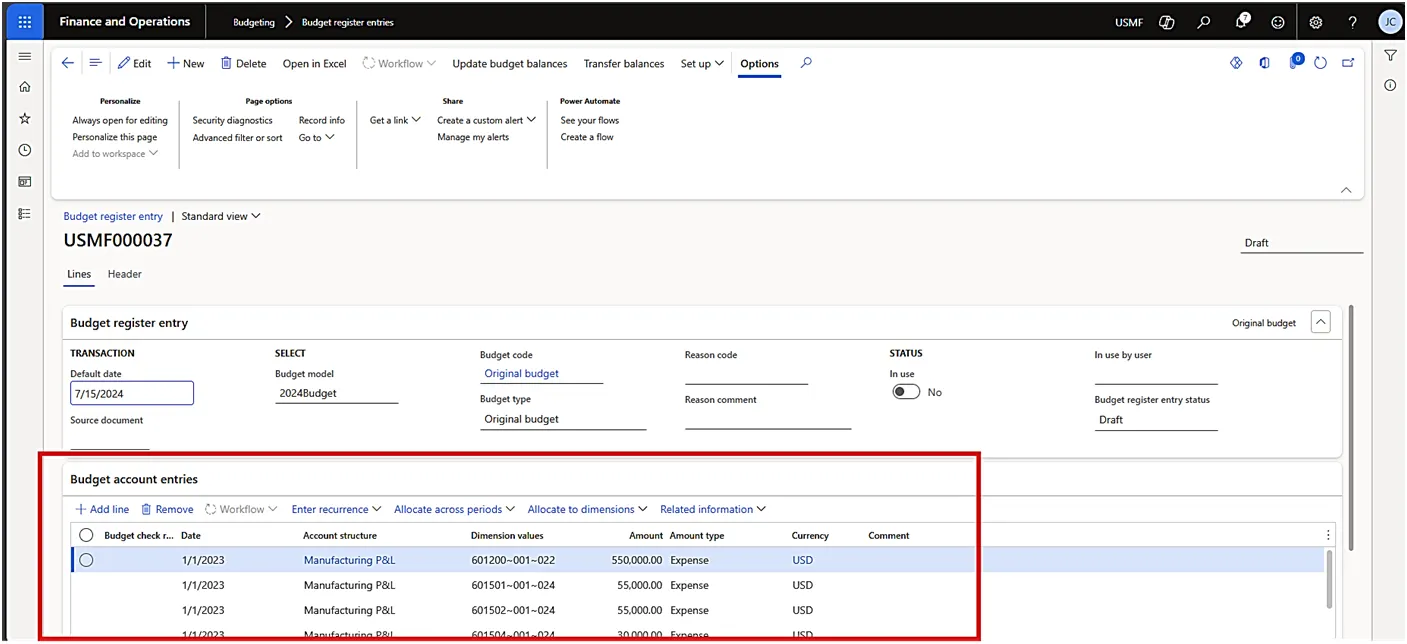

Finalized budget can be moved to Budget register entries and used for reporting and control purpose.

Budget planning with Microsoft Dynamics 365 Finance enables organizations to create, manage, and optimize their financial strategies with enhanced precision and efficiency. By leveraging automated workflows, integrated data, and scenario analysis, teams can improve collaboration, reduce errors, and make data-driven decisions that align with organizational goals. As budgeting becomes increasingly complex, D365 Finance offers a scalable solution that empowers finance teams to navigate challenges and drive strategic growth with confidence.

Author

Jaydeep Chandnani

Functional Lead – Microsoft Dynamics F&O